Investing with us

We believe your wealth can reflect who you are.

Why impact investing?

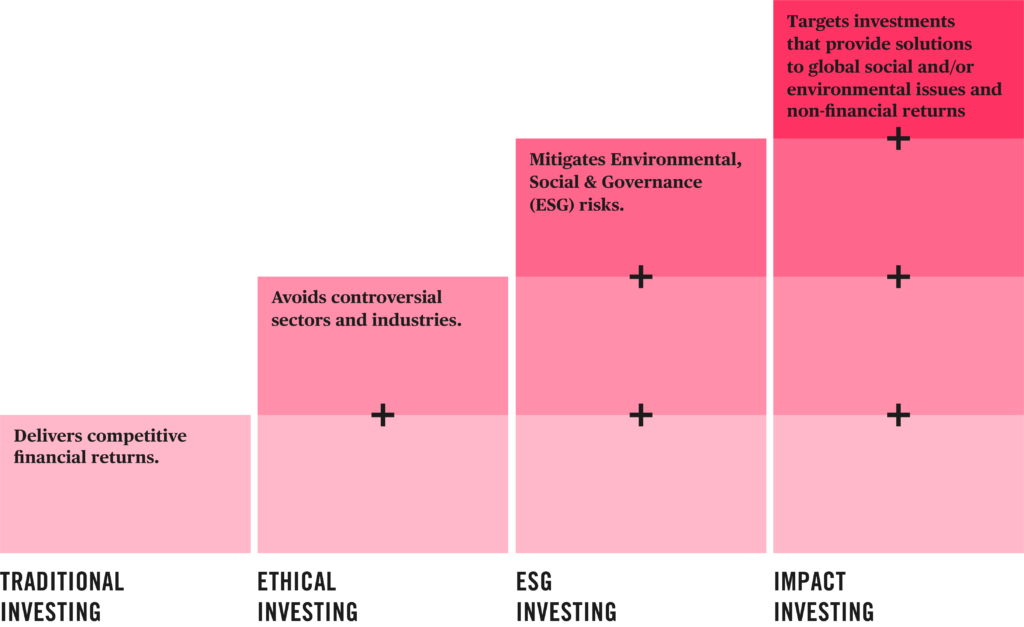

Impact Investing

It’s often a way for investors to express their personal values through their investments: using business to solve social and/or environmental problems.

How we invest your wealth

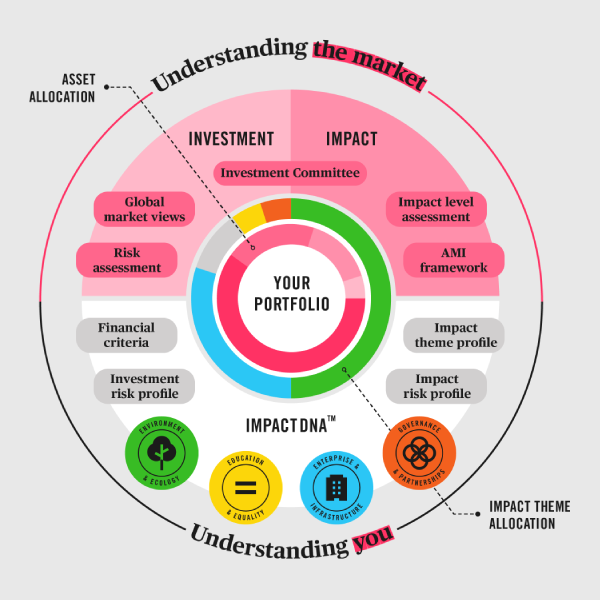

Our investment process is built around the people who invest with us – by combining your financial aims, your values, and the progress you want to see in the world.

- Discover your

ImpactDNA™

Based on research in sustainability and collaboration with leading behavioural scientists, the ImpactDNA™ process helps uncover and articulate the impact you want to have through your investments. - Build a purposeful portfolio

- Tell your impact story

We have a duty to our clients to manage risks (the externalities). But we also believe we have a duty to our communities and the planet to be responsible. For this reason we operate our business in line with what both these areas need.

Impact phrasebook

We’ve made every effort to keep our website jargon free, but realise that some expressions might need further explanation. This glossary is intended to help you understand some of the terms used in impact investing.

Meet the Tribe

We’re a team of wealth managers and impact specialists whose goal is to deliver long-term positive impact and growth for everyone. Our theory of change? To change the very nature of wealth and its impact.

Join the Tribe

Start realising the potential of your wealth by speaking to one of our wealth managers today.