We’re changing wealth management…

for good.

Realise your wealth potential

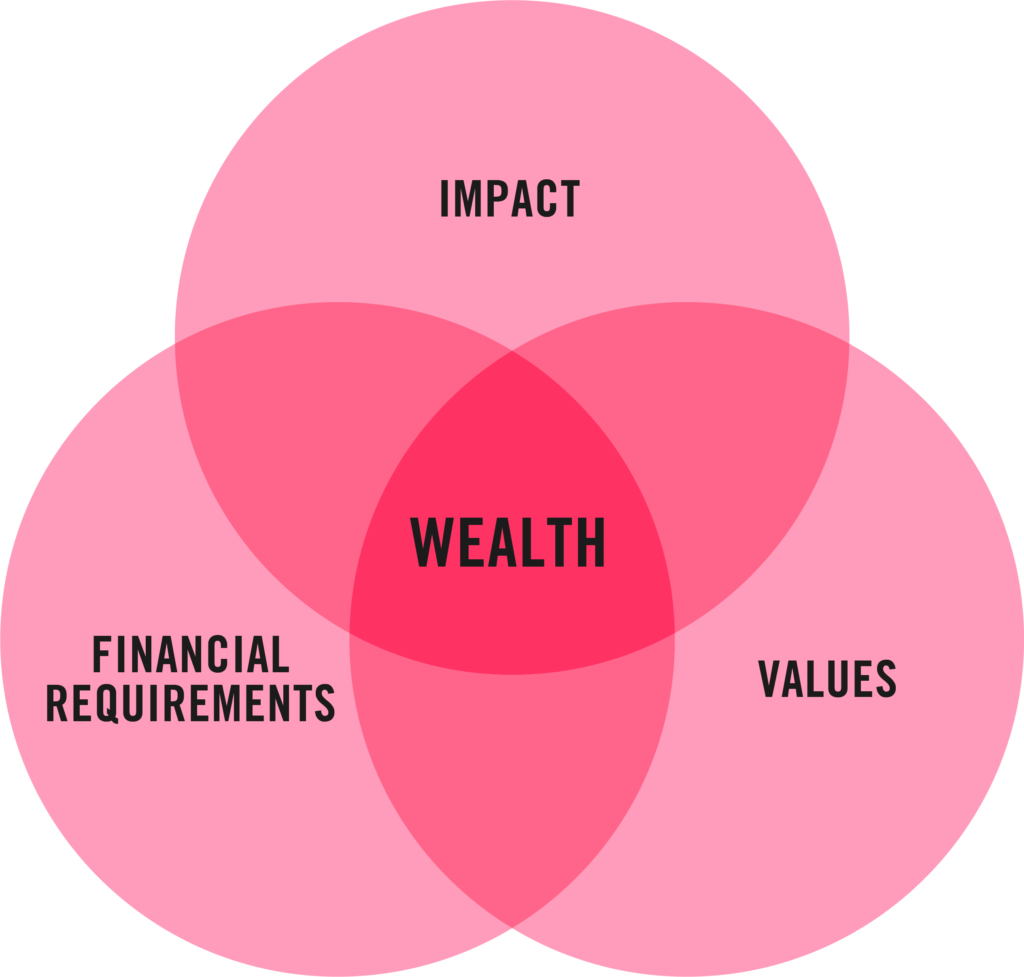

What if your wealth actually reflected your values? We set up Tribe with a clear goal: to help those who invest with us to achieve financial returns but also to bring about positive change for people and planet.

This means we only run portfolios for positive, sustainable impact. Sustainability is at the core of everything we do, from our mission as a business, to our operations, to our portfolios.

Create a purposeful portfolio

We offer clients

portfolio management services through diversified, multi-asset portfolios which are risk managed and aligned to each client’s impact preferences. This includes general investment accounts (GIAs), individual savings accounts (ISAs) and portfolio management in relation to your pension. We also provide

Advisory

- Invest in companies that represent what you care about.

- Make a positive impact on the world alongside financial returns.

- Create a more purposeful legacy.

We have a duty to our clients to manage risks (the externalities). But we also believe we have a duty to our communities and the planet to be responsible. For this reason we operate our business in line with what both these areas need.

How does it work?

You have the means to make the change – by combining your financial aims, your values, and the progress you want to see in the world. We work on a discretionary and advisory basis with individuals & families, companies, charities, as well as providing financial advisers with a sustainable impact MPS.

Individuals & Families

Achieve a greater level of impact with your wealth, whilst delivering your financial objectives.

Charities & Endowments

Align your assets to actively support your charity or endowment’s values and mission.

Financial Advisers

Our Sustainable Impact Model Portfolio Service (SIMPS) is designed for clients of financial advisers seeking an impact-led investment approach.

I felt overwhelmed with the responsibility of coming into money and confused about the ethical decisions I wanted to make. Becoming a client of Tribe doesn’t exempt you entirely from the negative impacts of the current financial system. But having reviewed other options, Tribe stood out as clearly aligning with my values. They’re able to engage in frank conversations about how best to bring my wealth in line with my values. I trust Tribe and have found them responsive and professional.

jamie andrews, Client

Join the Tribe

Start realising the potential of your wealth by speaking to one of our wealth managers today.